You're all caught up—no notifications available.

Explore All Exams at KGS

All Exams

Explore All Exams at KGS

Khan Sir Courses

Geography I Polity I History | World Map I Indian Map I Economics I Biology

UPSC & State PSC

UPSC I BPSC I UP-PSC I MP-PSC

State Exams

UP I Bihar I MP | Rajasthan

NEET | JEE | CUET | Boards

NEET | JEE | CUET | Boards

Defence Exams

NDA I CDS I CAPF I AFCAT I SSB I Agniveer

Police Exams

UP SI | Bihar SI | Delhi Police | UP Constable

SSC Exams

CGL I CPO I CHSL I MTS I SSC GD I Delhi Police

Foundation Courses

Physics I Chemistry I Biology I History I Geography I Polity I NCERT I Math I English | Map I Reasoning

Railway Exams

RRB | RPF

Teaching Exams

TET | Teaching | UGC

Banking Exams

SBI | RBI | IBPS

Engineering Exams

Civil | Electrical | Mechanical

UGC NET

UGC NET/JRF

Current Affairs provides you with the best compilation of the Daily Current Affairs taking place across the globe: National, International, Sports, Science and Technology, Banking, Economy, Agreement, Appointments, Ranks, and Report and General Studies

SYLLABUS

GS-2: Functions and Responsibilities of various Constitutional Bodies.

GS-3: Indian Economy and issues relating to planning, mobilisation of resources, growth, development and employment; Government Budgeting.

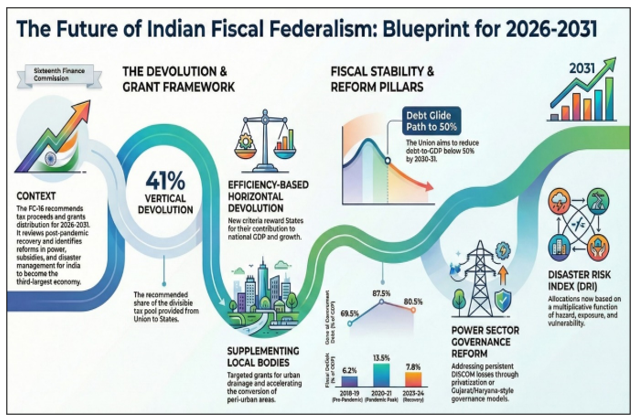

Context: The Report of the 16th Finance Commission was tabled in Parliament on February 1, 2026, for the five-year period between 2026-27 and 2030-31.

More on the News

• The President of India had constituted the 16th Finance Commission on 31 December 2023 under the chairmanship of Dr. Arvind Panagariya.

• As per the Terms of Reference (TOR), the XVIFC was mandated to submit a report covering a five-year period, making recommendations on:

Key Recommendations of the 16th Finance Commission

• Share of States in Central Taxes: The Commission retained the previous share vertical devolution, keeping states’ share in the divisible pool of central taxes at 41%.

• Fiscal Roadmap: The Commission has recommended that the Centre should bring down the fiscal deficit to 3.5% of GDP by 2030-31.

• Subsidy Expenditure: To address fiscal populism, it suggested rationalising subsidy schemes and introducing sunset clauses for non-merit subsidies.

• Power-Sector Reforms: The Commission recommended that states should actively pursue the privatisation of electricity distribution companies (DISCOMs).

• Public Sector Enterprise Reforms: The Commission recommended a review and closure of 308 inactive State Public Sector Enterprises (SPSEs).

Criteria for Devolution

The 16th FC used the following criteria for the Distribution of Central Taxes among States.

|

Criteria |

15th Finance Commission

(2021–26) |

16th Finance Commission

(2026–31) |

|

Income Distance |

45% |

42.5% |

|

Population (2011

Census) |

15% |

17.5% |

|

Demographic Performance |

12.5% |

10% |

|

Area |

15% |

10% |

|

Forest and Ecology |

10% |

10% |

|

Tax and Fiscal Efforts |

2.5% |

— |

|

Contribution to GDP |

— |

10% |

|

Total |

100% |

100% |

Explanation of Devolution Criteria and Recent Changes

• Per Capita GSDP Distance (Income Distance): The 16th FC has defined income distance as the difference between the per capita GSDP of a state and the average of the per capita GSDP of the top three large states with the highest per capita GSDP.

• Population (2011 Census): Distribution is based on each state’s population share as per the 2011 Census.

• Demographic Performance: The 15th FC had introduced this parameter to award states for controlling population on the basis of Total Fertility Rate (TFR). The 16th FC has redefined the criteria to measure population growth between 1971 and 2011 instead of the TFR.

• Area: It relates to devolution based on the geographical size of a State. The 16th FC has reduced its weightage, thus limiting the advantage earlier given to geographically large states.

• Forest and Ecology: While the weight remains the same, the 16th Finance Commission has introduced two new parameters while keeping the earlier parameters of the 15th FC.

• Contribution to GDP: The 16th FC has introduced this parameter to account for the contribution to national GDP.

• Removal of Tax and Fiscal Efforts: The earlier parameter that rewarded higher tax collection efficiency was dropped to simplify the formula and reduce overlap with GDP contribution.

Grants-in-aid

• The 16th FC has recommended grants worth Rs 9.47 lakh crore over the five-year period. These comprise grants for:

(i) Urban and Rural Local Bodies: The 16th FC has recommended grants worth Rs 4.4 lakh crore and Rs 3.6 lakh crore for rural and urban local bodies, respectively

(ii) Disaster Management: The Commission has recommended a disaster management corpus of Rs 2,04,401 crore for State Disaster Risk Management Funds (SDRF and SDMF). The cost-sharing pattern between the centre and states is recommended to be: (i) 90:10 for north-eastern and Himalayan states, (ii) 75:25 for all other states.

• The 16th FC has discontinued the following grants recommended by the 15th FC:

(i) revenue deficit grants

(ii) sector-specific grants

(iii) state-specific grants

NCERT Books

Resources

We love learning. Through our innovative solutions, we encourage ourselves, our teams, and our Students to grow. We welcome and look for diverse perspectives and opinions because they enhance our decisions. We strive to understand the big picture and how we contribute to the company’s objectives. We approach challenges with optimism and harness the power of teamwork to accomplish our goals. These aren’t just pretty words to post on the office wall. This is who we are. It’s how we work. And it’s how we approach every interaction with each other and our Students.

Come with an open mind, hungry to learn, and you’ll experience unmatched personal and professional growth, a world of different backgrounds and perspectives, and the freedom to be you—every day. We strive to build and sustain diverse teams and foster a culture of belonging. Creating an inclusive environment where every students feels welcome, appreciated, and heard gives us something to feel (really) good about.

Get Free academic Counseling & Course Details