You're all caught up—no notifications available.

Explore All Exams at KGS

All Exams

Explore All Exams at KGS

Khan Sir Courses

Geography I Polity I History | World Map I Indian Map I Economics I Biology

UPSC & State PSC

UPSC I BPSC I UP-PSC I MP-PSC

State Exams

UP I Bihar I MP | Rajasthan

NEET | JEE | CUET | Boards

NEET | JEE | CUET | Boards

Defence Exams

NDA I CDS I CAPF I AFCAT I SSB I Agniveer

Police Exams

UP SI | Bihar SI | Delhi Police | UP Constable

SSC Exams

CGL I CPO I CHSL I MTS I SSC GD I Delhi Police

Foundation Courses

Physics I Chemistry I Biology I History I Geography I Polity I NCERT I Math I English | Map I Reasoning

Railway Exams

RRB | RPF

Teaching Exams

TET | Teaching | UGC

Banking Exams

SBI | RBI | IBPS

Engineering Exams

Civil | Electrical | Mechanical

UGC NET

UGC NET/JRF

Current Affairs provides you with the best compilation of the Daily Current Affairs taking place across the globe: National, International, Sports, Science and Technology, Banking, Economy, Agreement, Appointments, Ranks, and Report and General Studies

SYLLABUS

GS-3: Indian Economy and issues relating to planning, mobilisation of resources, growth, development and employment.

Context: Recently, the Reserve Bank of India (RBI) notified the Foreign Exchange Management (Borrowing and Lending) (First Amendment) Regulations, 2026.

More on the News

• The amendment revises the External Commercial Borrowing (ECB) framework under FEMA to rationalise limits, strengthen monitoring, and align the rules with evolving global financing practices.

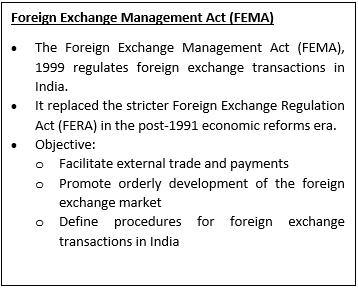

• The amendment introduces structural changes to the ECB regime under the Foreign Exchange Management Act (FEMA), 1999.

• The revised regulations were finalised after stakeholder consultations on the draft released in October 2025.

• Existing ECBs will continue under the earlier framework, but reporting must follow the new compliance norms.

Key Highlights of the Amendment

• Expanded Eligible Borrowers and Lenders: Any non-individual resident entity incorporated under Indian law can raise ECB from recognised overseas lenders, including IFSC-based institutions.

• Revised Borrowing Limits: ECB borrowing is capped at the higher of USD 1 billion or 300% of net worth, with exemptions for regulated financial entities.

• Minimum Average Maturity Period (MAMP): The standard MAMP is 3 years, while manufacturing entities can access shorter maturities (1–3 years) within prescribed limits.

• Cost of Borrowing Liberalised: Borrowing costs are largely market-determined, with ceilings only for very short-term loans and arm’s-length pricing for related-party ECBs.

• Currency Flexibility: ECBs can be raised in foreign currency or INR, with permitted currency conversion under safeguards.

• End-Use Restrictions Strengthened: ECB proceeds cannot be used for activities like real estate, chit funds, capital markets, certain agriculture uses, NPA-linked refinancing, or prohibited on-lending.

• Reporting and Compliance Reforms: Updated reporting mandates include ECB-1/ECB-2 filings, stricter timelines, late submission fees, and new compliance disclosures.

• Treatment of ECB Proceeds: ECB funds must flow through designated AD banks and can be temporarily parked in approved short-term instruments until use.

Significance of the Amendment

• Rationalisation of ECB Framework: The amendment simplifies borrowing limits and eligibility, making the framework more transparent and rules-based.

• Improved Access to Global Capital: A wide borrower and lender base enhances access to overseas funds and boosts capital inflows.

• Stronger Regulatory Oversight: Tighter end-use restrictions and improved reporting strengthen prudential supervision.

• Support to Manufacturing and Infrastructure: Relaxed maturity norms encourage long-term investment in the productive sector.

• Prevention of Financial Misuse: Curbs on NPA refinancing and speculative uses reduce regulatory arbitrage and evergreening.

Source :

Bizzbuzz

BFSI

Business Standard

Course Related Query:

Ask Your DoubtsStore Related Query:[email protected]NCERT Books

Resources

We love learning. Through our innovative solutions, we encourage ourselves, our teams, and our Students to grow. We welcome and look for diverse perspectives and opinions because they enhance our decisions. We strive to understand the big picture and how we contribute to the company’s objectives. We approach challenges with optimism and harness the power of teamwork to accomplish our goals. These aren’t just pretty words to post on the office wall. This is who we are. It’s how we work. And it’s how we approach every interaction with each other and our Students.

Come with an open mind, hungry to learn, and you’ll experience unmatched personal and professional growth, a world of different backgrounds and perspectives, and the freedom to be you—every day. We strive to build and sustain diverse teams and foster a culture of belonging. Creating an inclusive environment where every students feels welcome, appreciated, and heard gives us something to feel (really) good about.

Get Free academic Counseling & Course Details