You're all caught up—no notifications available.

Explore All Exams at KGS

All Exams

Explore All Exams at KGS

Khan Sir Courses

Geography I Polity I History | World Map I Indian Map I Economics I Biology

UPSC & State PSC

UPSC I BPSC I UP-PSC I MP-PSC

State Exams

UP I Bihar I MP | Rajasthan

NEET | JEE | CUET | Boards

NEET | JEE | CUET | Boards

Defence Exams

NDA I CDS I CAPF I AFCAT I SSB I Agniveer

Police Exams

UP SI | Bihar SI | Delhi Police | UP Constable

SSC Exams

CGL I CPO I CHSL I MTS I SSC GD I Delhi Police

Foundation Courses

Physics I Chemistry I Biology I History I Geography I Polity I NCERT I Math I English | Map I Reasoning

Railway Exams

RRB | RPF

Teaching Exams

TET | Teaching | UGC

Banking Exams

SBI | RBI | IBPS

Engineering Exams

Civil | Electrical | Mechanical

UGC NET

UGC NET/JRF

Current Affairs provides you with the best compilation of the Daily Current Affairs taking place across the globe: National, International, Sports, Science and Technology, Banking, Economy, Agreement, Appointments, Ranks, and Report and General Studies

SYLLABUS

GS-2: Effect of Policies and Politics of Developed and Developing Countries on India’s interests, Indian Diaspora.

GS-3: Indian Economy and issues relating to planning, mobilization of resources, growth, development and employment.

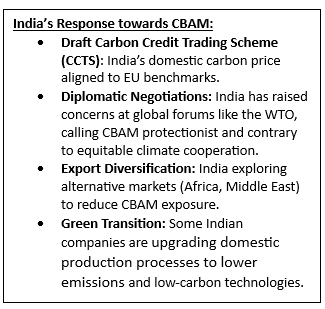

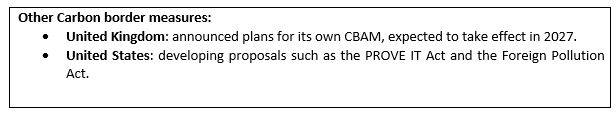

Context: The European Union’s (EU) Carbon Border Adjustment Mechanism (CBAM) came in to effect on January 1, 2026, that imposes a carbon levy on imports of carbon-intensive products.

More on the News

What is CBAM?

• It is the EU’s mechanism to price carbon emitted during the production of carbon-intensive goods that are entering the EU, and to encourage cleaner industrial production in non-EU countries.

• Objective: To align with Europe's push to cut greenhouse gas emissions by 55% by 2030.

• Phases of CBAM: Transitional phase was implemented from 1 October 2023 to 2025.

• Mechanism: EU importers must register with national authorities, report the carbon in their imports, and buy certificates linked to EU ETS prices.

Impact of CBAM on India

• Increased Export Cost: CBAM is expected to raise costs for exporters of products such as steel, iron, aluminium, cement and fertilisers, potentially reducing their trade competitiveness.

• High Compliance Burden: CBAM’s complex data and verification rules may raise compliance costs and drive smaller exporters out of the EU market.

• Declining Export: The reporting phase of CBAM led to a 24.4 % drop in steel and aluminium exports from India to the EU.

• Non-tariff trade barrier: Restricts trade not through customs duties, but via regulatory, cost, and compliance requirements.

• Sector specific Impact: Steel and aluminium exporters will be most affected as in these sectors power generated from coal significantly raises the carbon burden and, therefore, the CBAM cost.

Concerns from Developing countries:

• Uniform emissions standards to both developed and developing economies impose disproportionate burdens and risk deepening existing trade inequalities as highlighted during UNFCCC COP30 in Brazil.

• Unilateral climate-linked trade measures also undermine multilateral trade principles and conflict with the concept of Common but Differentiated Responsibilities and Respective Capabilities (CBDR-RC).

• Shift of Decarbonisation costs: CBAM risks shifting the cost of decarbonisation onto poorer countries, also it does not address historical responsibilities or structural inequalities.

Sources:

Climate

Taxation

Economic Times

New Indian Express

Financial Express

EU implements carbon tax starting from January 1

Design Linked Incentive (DLI) Scheme

Pradhan Mantri Matru Vandana Yojana completes nine ye

195th Birth Anniversary of Savitribai Phule

Draft Pesticides Management Bill, 2025

Trump's 'Donroe Doctrine' seeks influence over Western Hemisphere citing old US policy

Global Minimum Corporate Tax Deal

The Fifth edition of “Trade Watch Quarterly”

Environment Panel Clears Kalai-II Hydropower Project Amid Concerns Over The White-Bellied Heron

NCERT Books

Resources

We love learning. Through our innovative solutions, we encourage ourselves, our teams, and our Students to grow. We welcome and look for diverse perspectives and opinions because they enhance our decisions. We strive to understand the big picture and how we contribute to the company’s objectives. We approach challenges with optimism and harness the power of teamwork to accomplish our goals. These aren’t just pretty words to post on the office wall. This is who we are. It’s how we work. And it’s how we approach every interaction with each other and our Students.

Come with an open mind, hungry to learn, and you’ll experience unmatched personal and professional growth, a world of different backgrounds and perspectives, and the freedom to be you—every day. We strive to build and sustain diverse teams and foster a culture of belonging. Creating an inclusive environment where every students feels welcome, appreciated, and heard gives us something to feel (really) good about.

Get Free academic Counseling & Course Details